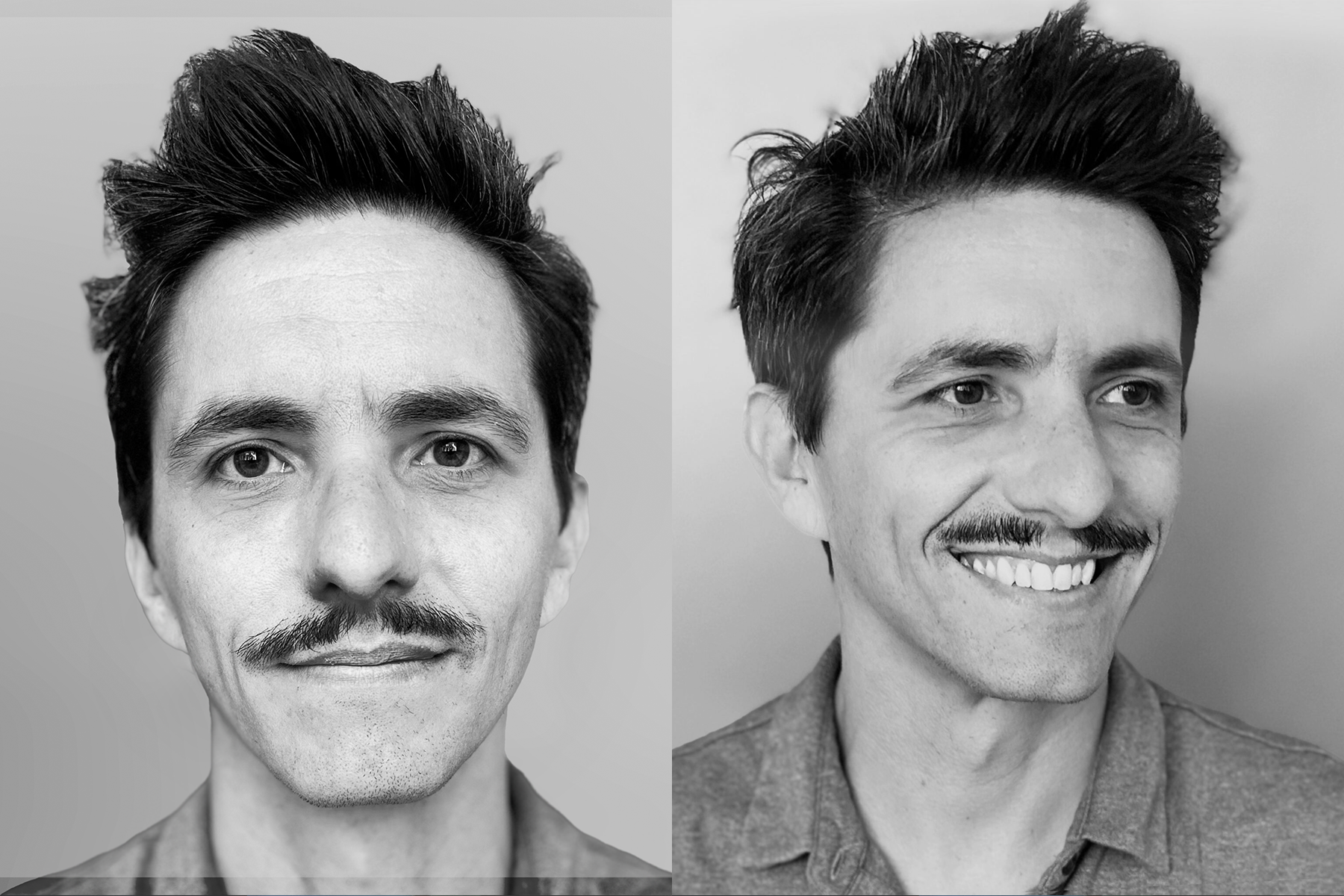

In what is a recurring feature, Finopotamus will profile interesting and intriguing tech professionals who are positively impacting the credit union industry. For this issue, we visited with WaveCX Founder and CEO Jonathan Tvrdik.

By W.B. King

With the goal of enabling financial institutions (FIs) to leverage existing data and drive better engagement through digital channels, WaveCX’s attitude is rooted in the punk rock scene.

“I started in tech at 14 when I was playing in punk bands. The DIY (do-it-yourself) ethos of that scene was huge for me,” WaveCX Founder and CEO Jonathan Tvrdik told Finopotamus. “My best friend, who played bass, and I realized we needed a website, so he taught me some basic HTML, and I slapped together a raggedy Geocities site.”

After completing degrees at Creighton University and UCLA, the latter was for screenwriting, Tvrdik held a number of positions at a various companies, including executive creative director at a digital agency that also had a punk rock vibe.

“This was back in the early days of the internet, when big agencies didn’t even have digital teams and would outsource to young, hungry folks like us. We ended up building microsites for brands like Samsung and Diet Coke,” he shared. “Eventually, as we grew up, we added strategy and product into the mix and sold the business to S4 Capital.”

The next stop on his professional journey was serving as a fintech consultant for companies like NCR, Deloitte, and Finastra. “Seeing how engagement was lacking in the market led me to create WaveCX,” he said.

An Ocean’s 11 Approach

Founded in 2021, the Omaha, Neb.-based WaveCX counts 17 FIs as clients, three of which are credit unions. “We’re a tight-knit team of five, all elder millennials. We knew life before the internet yet were shaped by its explosion and now teach our parents and our children how to use it,” he said. “It’s a really interesting spot to be in.”

Tvrdik likens his team to the Ocean’s 11 film. “Everyone’s got their specialty, and together we pull off something big. Our mission is to build a robust engagement platform that beats everything else out there, because we’re all extremely competitive, designed for forward-thinking financial institutions.”

He underscored that the team are co-workers, not family, charged with getting a job done on behalf of their clients.

“It’s a challenging job that’s designed to reward you with money or stock, but still, just a job. And hopefully a job you love. But your family is at home. We make people take PTO (personal time off), discourage after-hours emails and Slack messages, and if you’re drafting something on the weekend, schedule it to send at 8 a.m. on Monday,” he said. “We’re also not in the ‘rocket ship emoji, grow, grow, grow’ mindset. We hire selectively, bringing in senior people who still love getting their hands dirty with code or business.”

Making Sense of Mountains of Data

Over the course of Tvrdik’s career, he said there have been “huge shifts” in the tech space and those professionals operating within the industry.

“When I started, digital was either some opaque backend on-prem stuff or flashy front ends that didn’t really do much. Barriers to entry were high, and everything you did came with a ton of technical debt,” he continued. “My former partner, Joe Olsen at our old agency (now at S4 Capital), used to say, ‘that was the end of the digital age—the age where everyone was feverishly building new systems.’ Now, he’d say, ‘we’re in the connected age.’”

Today, Tvrdik said, tech is about lower barriers, automation, platforms, and connected services. A tech trend he is paying attention to is generative artificial intelligence (AI) and explained that the company recently released Curator, an AI-powered search tool designed specifically for FIs.

“It’s built to navigate through internal documents, WaveCX content, and even external sources to give users exactly what they need, whether they’re employees troubleshooting or members looking for quick answers,” he noted. “But I’m cautious about AI in general—it’s not the silver bullet everyone thinks it is. There are huge legal, ethical, and moral risks.”

To this end, he said his team is using AI in a targeted manner. “Like how someone might have used the first calculator. Our focus with AI is helping FI employees and customers make sense of the mountains of data they deal with daily.”

Additional AI applications of interest include personalization that would further allow FIs to create mass marketing campaigns that he said, “feel one-on-one, with tiny, bespoke messages tailored for each individual.”

He continued. “That’s where I see things going—massive engagement campaigns designed uniquely for each person, with completely personalized calls to action. We’re also keeping an eye on hyper automation, edge computing, and privacy-enhancing technologies—all of which are pushing the boundaries of efficiency, real-time processing, and data privacy in ways that will significantly impact how financial institutions engage.”

A CU Punk Rock Vibe

Over the course of the last several years, Tvrdik said there are increasing numbers of productive fintech and credit unions partnerships, a trend he believes should continue.

“Credit unions got more hungry talent—who aren’t always younger, by the way—eager to modernize their tech. Because they’re so connected to their communities, they know exactly what their members want, and they’re highly motivated to act fast,” he said. “It’s got a very punk rock vibe—scrappy, quick, and ready to make things happen.”

Speaking on behalf of his company, he said the credit unions they work with “love” the partnership. “They’re excited that we’re bringing tools typically reserved for big banks into the credit union space,” he continued. “We’re giving them the ability to engage at scale and personalize their services without the huge cost or resource burden.”

https://www.finopotamus.com/post/tech-people-in-the-know-wavecx-s-jonathan-tvrdik